10/08/2021

TWC Clarifies 2nd Quarter Payment Deadline

The Texas Workforce Commission (TWC) recently sent out incorrect payment deadlines on their Statement of Employer Accounts, which are generated by its Unemployment Insurance Tax System. On August 30, the TWC clarified that the second quarter tax payment deadline is actually September 30, 2021. Interest will begin to accrue October 1 for payments not made by that date. Below are the deadlines released by the TWC.

2021 TAX PAYMENT DEADLINES

- The first quarter tax payment was due by August 2, 2021.

- The second quarter tax payment is due by September 30, 2021.

- The third quarter tax payment is due by November 1, 2021.

- The fourth quarter tax payment is due by January 31, 2022.

2021 TAX REPORT DEADLINES

- The first quarter 2021 tax report should have been filed by May 7, 2021.

- The second quarter 2021 tax report should have been by August 2, 2021.

- The third quarter 2021 tax report must be filed by May November 1, 2021.

- The fourth quarter 2021 tax report must be filed by January 31, 2022.

TWC RESOURCES

On the TWC’s Employer Resources webpage (link below), you will find the latest information regarding tax report filing and payment due dates: https://www.twc.texas.gov/news/employer-resources

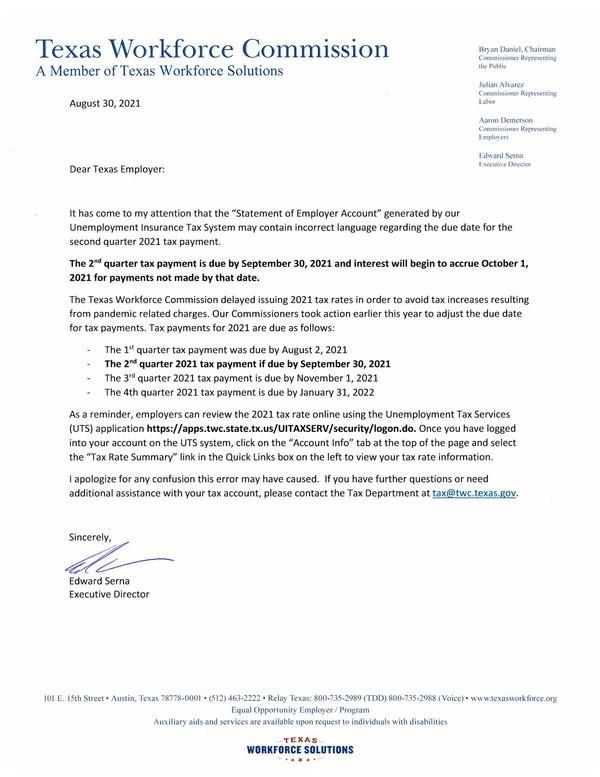

TWC'S NOTICE FROM AUGUST 30, 2021

Below is a copy of the letter from TWC Executive Director, Edward Serna, which was distributed August 30.

FOR MORE INFORMATION

If you have any questions, please contact

- our HR team at 210–775–6082 or [email protected],

- our Payroll team at 210–293–6620 or [email protected],

- or our office via our toll-free number (1–888–757–2104)