7/28/2022, revised 7/28/2023

TWO RETIREMENT PLAN OPTIONS Still Available this Year

WITH POTENTIAL BENEFITS FOR OWNERS & KEY EMPLOYEES

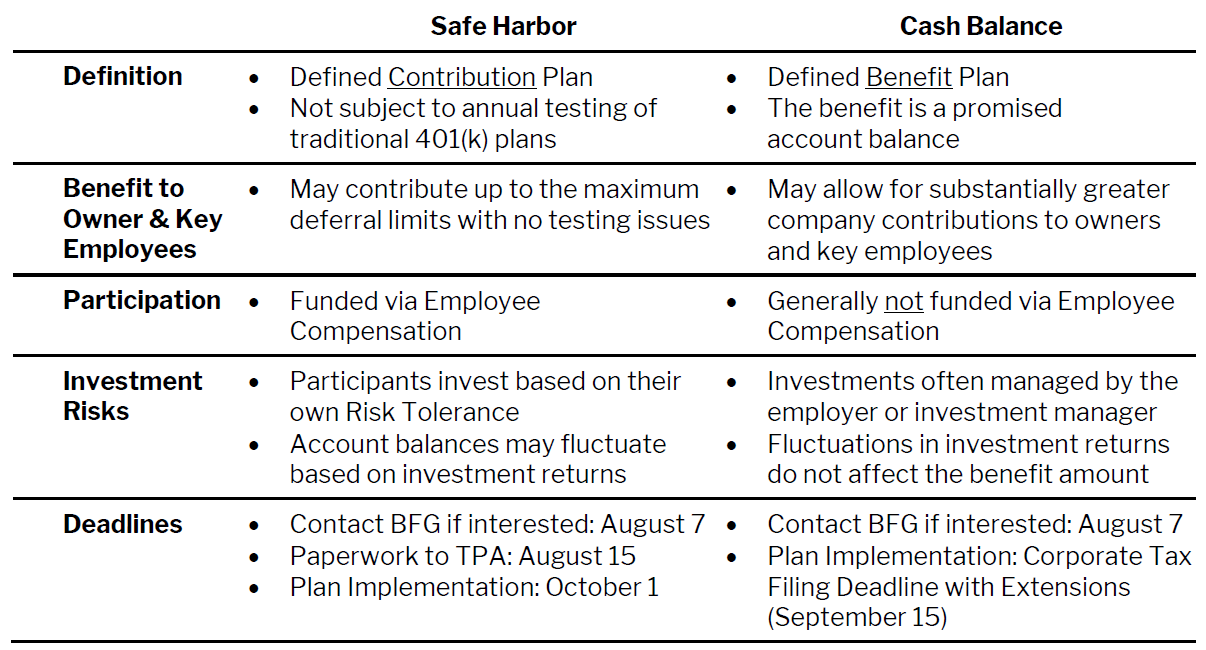

Safe Harbor 401(k) and Cash Balance Plans are two options that may allow company owners and key employees to save more for retirement. Please note: both types of plans can still be set up this year in order to provide tax savings benefit for the full tax year.

As noted below, the deadline for implementation of a Safe Harbor 401(k) plan is October 1st, however, most third-party plan administrators (TPAs) require plan paperwork by or around August 15th. In order to implement your plan by the deadline, please contact BFG by August 7th if you’re interested in getting started.

Safe Harbor and Cash Balance Plan designs are beneficial in situations where owners and key employees would like to contribute the maximum allowable deferral even if other employees make little or no contributions. Below is an explanation of the major differences between Cash Balance and Safe Harbor 401(k) Plans*:

FOR MORE INFORMATION

Please contact BFG by 8/7 if you are interested in implementing a Safe Harbor 401(k) Plan!

For more information or assistance, please contact our Corporate Retirement team at 210–745–6393, toll-free at 1–888–757–2104, or [email protected].

*Source: United States Department of Labor