4/20/2020

THE CARES ACT: IMPACT ON INDIVIDUALS

By Scott Portlock, CFP®, CLU®

BACKGROUND

On March 27, 2020, President Trump signed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) into law. The CARES Act has been enacted as a direct response to the COVID-19 pandemic and is intended to provide immediate and ongoing economic relief to individuals and businesses affected by the crisis. Although the act also contains important provisions relating to aiding hospitals, the airline industry, and municipalities, along with a broad variety of other aspects of the economy, this summary is intended to address the key provisions relating specifically to individuals concerning Recovery Rebates, Retirement Account Distributions, Charitable Giving, and Educational Provisions for Student Borrowers.

RECOVERY REBATES FOR INDIVIDUALS (SECTION 2021)

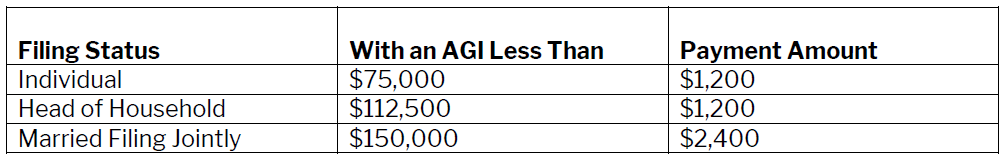

The CARES Act will provide a refundable tax credit (stimulus check) to individuals and families who are at or below the following Adjusted Gross Income (AGI) thresholds:

In addition, families will receive an extra $500 per child under the age of 17.

Those with an AGI greater than their threshold level will have their payment phased out by 5 percent per dollar of qualified income, or $50 per $1,000 earned that is over the level. For example,

- The rebate phases out entirely at $99,000 for single taxpayers with no children and at $198,000 for joint taxpayers with no children.

- For a Head of Household with One Child, the rebate would be phased out at $146,500.

Nonresident aliens, individuals claimed as dependents on someone else’s return, and estates and trusts are not eligible for these payments.

The amount of an individual’s recovery rebate received this year will be based on the AGI from their latest return filed with the IRS, from either 2018 or 2019. The rebate will then be “trued up” when their 2020 return is filed. For example, an individual with a historically high income may not initially receive a benefit if their 2019 AGI is greater than their threshold limit in the above table. If in 2021, their 2020 tax return shows an AGI below threshold, qualifying them for a benefit, they will receive a rebate check at that time.

For individuals who receive Social Security benefits and do not file taxes, the government will use the information on their Social Security statement to determine eligibility. Those who are not receiving Social Security benefits and who also do not file income tax returns will effectively be required to file a return to become eligible for a stimulus check.

The timing of when the payments will begin is undetermined as the law states payments will be made “as rapidly as possible.” The last stimulus plan (2008) started distributing amounts in two to three months. Government officials have expressed an intent to have the payments sent out in mid to late April and the manner of payments are to be as follows:

- Current Social Security recipients will receive their Recovery Rebate in the same manner they are receiving their Social Security benefits.

- The CARES Act authorizes electronic payments to all individuals currently using Direct Deposit for IRS tax refunds, and they will be made to the same account.

- For all other individuals, rebate checks will be sent to the last address on record.

SPECIAL RULES FOR THE USE OF RETIREMENT FUNDS (SECTION 2202)

Distributions from Retirement Accounts

The CARES Act creates Coronavirus-Related Distributions, which are defined as penalty-free distributions up to $100,000 made from IRAs, employer-sponsored retirement plans, or a combination of both. These distributions need to be made in 2020, and the individual must have been impacted in one of the following ways:

- Have been diagnosed with COVID-19

- Have a spouse or dependent who has been diagnosed with COVID-19

- Experienced adverse financial consequences as a result of being quarantined, furloughed, being laid-off, or having work hours reduced because of the disease

- Are unable to work because they lack childcare as a result of the disease

- Own a business that has closed or operates under reduced hours because of the disease

- Or based on other factors as determined by the IRS

The tax benefits of Coronavirus-Related Distributions include individuals being able to spread the taxation of the withdrawn amount over the next three tax years (2020 to 2022), rather than including the full amount as taxable income in 2020. Individuals may also recontribute any amounts withdrawn under this provision at any time over the three-year period, tax free, even if the amount being returned exceeds the annual plan contribution limit.

Loans from Employer-Sponsored Retirement Plans

Many employer-sponsored plans (for example, 401(k), 403(b)) offer participants the option to take a loan on a portion of their retirement assets. For those individuals who have been impacted by the coronavirus (as defined in the section above), the CARES Act has modified the plan loan rules as follows:

- The CARES Act doubles the amount that may be borrowed from $50,000 to $100,000.

- 100% of the Vested Balance may be used. This differs from the normal rule which allows an individual with a vested balance that exceeds $20,000 to take a loan up to 50% of the amount with a maximum limit of $50,000.

- Loan payments taken in 2020 may be delayed for up to one year.

TEMPORARY WAIVER OF REQUIRED MINIMUM DISTRIBUTION FOR CERTAIN RETIREMENT PLANS AND ACCOUNTS (SECTION 2203)

Under the CARES Act, all RMDs for 2020 are suspended. This applies to Traditional IRAs, SEP IRAs, SIMPLE IRAs, as well as 401(k), 403(b), and Government 457 plans. It also includes individuals who turned age 70½ in 2019 and were waiting until April 1, 2020, to take their first RMD. These individuals will also miss taking their second RMD which would normally be due before December 31, 2020.

If an individual has taken an RMD within the last 60 days, you may be able to return it to your retirement account without penalty before the expiration of 60 days. If you took your RMD more than 60 days ago, then it is likely you will need to qualify for a COVID-19-related distribution (as defined in the section above) in order to be able to return the distribution to the account without penalty.

The CARES Act suspension of RMDs for 2020 also impacts the 5 Year Rule that applies to Non-Designated Beneficiaries (e.g., charities, estates, trusts) who inherit a retirement account prior to the decedent reaching their required beginning date. Normal these beneficiaries would have to distribute the entire account balance within 5 years. The CARES Act, however, allows 2020 to be ignored for those beneficiaries provided the decedent died in any year between 2015 and 2019.

CHARITABLE CONTRIBUTIONS

Allowance of Partial Above the Line Deduction of Charitable Contributions (Section 2204)

The CARES Act also introduced a new above-the-line deduction for individuals who do not itemize deductions. These individuals can make a $300 cash donation to qualifying charities (as defined in IRC Section 170(c)) and deduct the donation in computing adjusted gross income. This deduction is available in addition to the standard deduction and is permanent beginning in 2020.

The Modification of Limitations on Charitable Contributions During 2020 (Section 2205)

The Act also temporarily increased the AGI limit on cash contributions made to qualifying charities from 60% to 100% of AGI. This change could provide certain individuals an opportunity to eliminate their 2020 tax liability based on their charitable contributions.

It should be noted that donor advised funds (DAFs) and 509(a)(3) organizations are expressly prohibited from receiving these contributions.

EDUCATION - STUDENT LOAN RELIEF

Temporary Relief for Borrowers (Section 3513)

Student Loan Payments Deferred Until September 30, 2020 - The CARES Act temporarily suspends payments due on federal student loans, as well as the involuntary collection on any such loans, including offsetting a taxpayer’s tax refund. It is important note that this period of time will continue to count toward any loan forgiveness program; therefore, any student borrower who intends to qualify for a program that will ultimately forgive their student should pause payments.

The CARES Act specifically limits the ability to involuntarily collect on taxpayer refunds through September 30, 2020. This means that individuals with student debt, who are delinquent on their payments and subject to a reduction of their tax refund, should file their return early to ensure they are able to receive their full refund.

Exclusion from Income of Employer Payment of Employee Student Loans (Section 2206)

In general, amounts paid by an employer to an employee to pay student debt are considered compensation and subject to the income tax. For the rest of this year, an employer can pay an employee’s student debt (up to $5,250, aggregated with other educational assistance) without the employee having to include such amounts as income. As such, the total tax-free education assistance an employer can provide to an employee in 2020 is $5,250.