4/20/2020

THE CARES ACT: EXPANDED UNEMPLOYMENT

By Meghan Jaskowiak

BACKGROUND

On March 27, 2020, President Trump signed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) into law. The CARES Act has been enacted as a direct response to the COVID-19 pandemic and is intended to provide immediate and ongoing economic relief to individuals and businesses affected by the crisis. This summary covers important details on the expanded unemployment, which the CARES Act provides.

HOW DOES THE CARES ACT AFFECT UNEMPLOYMENT?

The CARES Act allows those who are collecting unemployment to receive an additional $600 per week of federal funds in addition to their state unemployment benefits. Per the law, individuals who are covered under the Pandemic Unemployment Assistance (PUA) can collect for up to 39 weeks, though the Act states that this timeframe could be extended by future legislation.

The CARES Act also expands who is covered under PUA. Unemployment is typically available to individuals who are otherwise able to work except for the fact that they are unemployed or partially employed. The CARES Act expands unemployment so that the individuals, who are unable or unavailable to work for the following reasons, would be eligible to receive PUA:

- the individual has been diagnosed with COVID-19 or is experiencing symptoms of COVID-19 and seeking a medical diagnosis

- a member of the individual's household has been diagnosed with COVID-19

- the individual is providing care for a family member or a member of the individual's household who has been diagnosed with COVID-19

- a child or other person in the household for which the individual has primary caregiving responsibility is unable to attend school or another facility that is closed as a direct result of the COVID-19 public health emergency and such school or facility care is required for the individual to work

- the individual is unable to reach the place of employment because of a quarantine imposed as a direct result of the COVID-19 public health emergency

- the individual is unable to reach the place of employment because the individual has been advised by a health care provider to self-quarantine due to concerns related to COVID-19

- the individual was scheduled to commence employment and does not have a job or is unable to reach the job as a direct result of the COVID-19 public health emergency

- the individual has become the breadwinner or major support for a household because the head of the household has died as a direct result of COVID-19

- the individual has to quit his or her job as a direct result of COVID-19

- the individual's place of employment is closed as a direct result of the COVID-19 public health emergency

- the individual is self-employed, is seeking part-time employment, does not have sufficient work history, or otherwise would not qualify for regular unemployment or extended benefits

Individuals who cannot claim PUA include the following:

- someone who has the ability to telework with pay

- someone who is receiving paid sick leave or other paid leave benefits, regardless of whether they meet any of the qualifications above

APPLYING FOR UNEMPLOYMENT

In order to get both state and federal unemployment benefits, you will need to apply through your state’s unemployment website. Currently, these websites are getting a lot of traffic, so the agency that administers unemployment may have some recommendations about when you apply. For example, the Texas Workforce Commission (TWC) recommends applying between 10:00 PM and 8:00 AM.

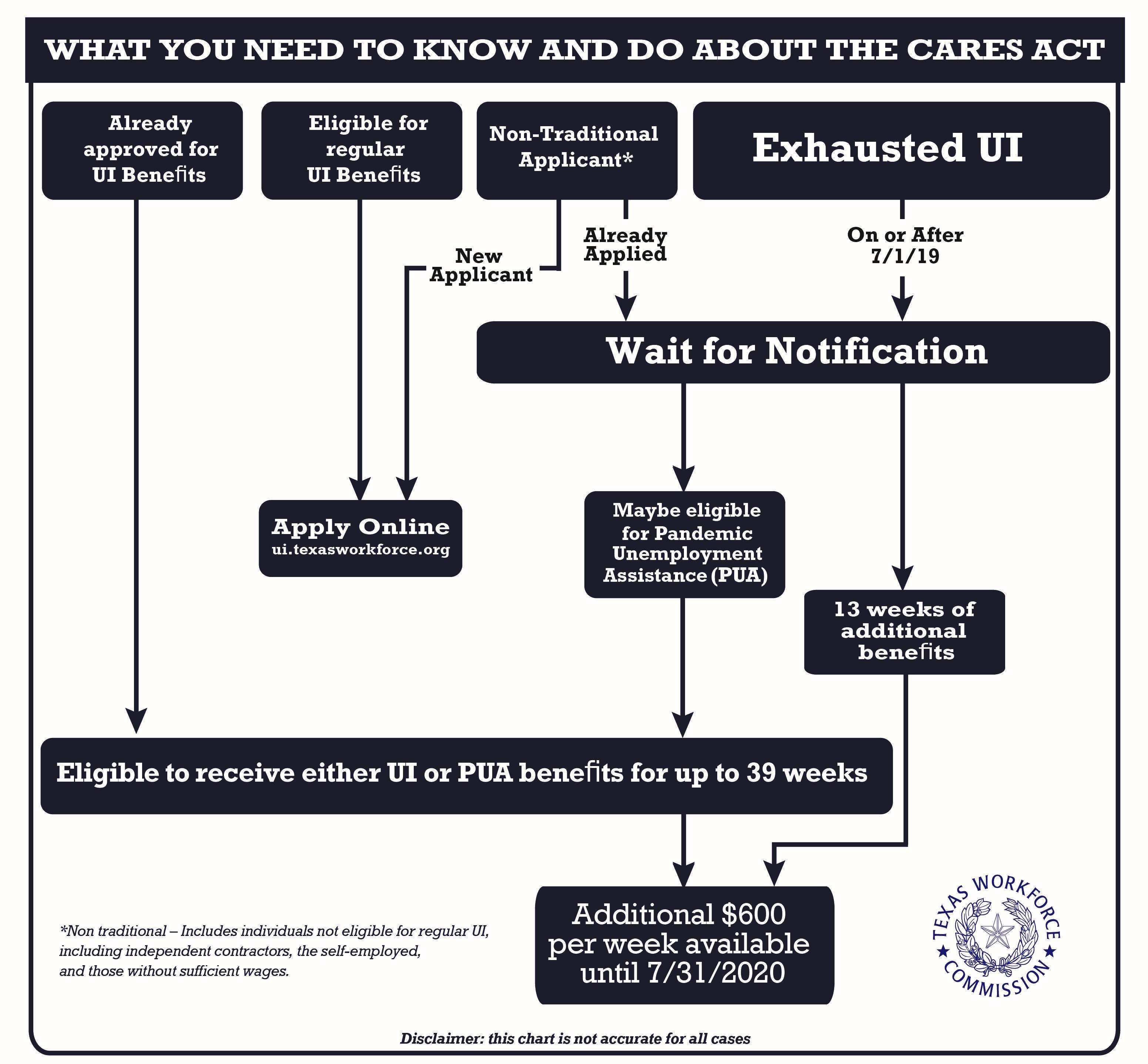

The TWC has posted resources up for individuals seeking unemployment and states on their website that they are “taking action to implement the new law and working with the Department of Labor to implement the act while continuing to work tirelessly to process unemployment insurance claims caused by the coronavirus (COVID-19) pandemic.” The following flow chart explains the process for applying for unemployment benefits with the TWC.

Please note, for applicants who have already exhausted their benefits, the TWC website states that they will determine whether you qualify and notify you by mail. In addition, if an applicant “applied for unemployment benefits but lacked the necessary wages to qualify, no action is needed. [The TWC] will determine if you qualify under the new stimulus bill and notify you by mail or electronic correspondence of your eligibility.”

IF YOU DON'T QUALIFY FOR UNEMPLOYMENT

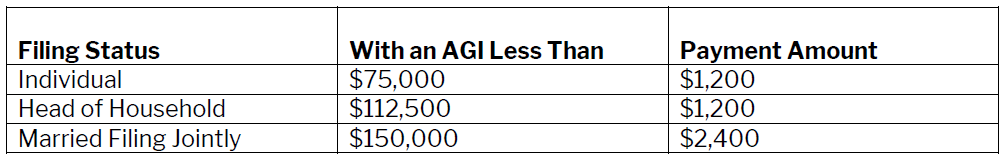

Even if you do not qualify for unemployment, remember that the CARES Act will provide a refundable tax credit (stimulus check) to individuals and families who are at or below the following Adjusted Gross Income (AGI) thresholds:

In addition, there are employers who are hiring, like grocery stores, delivery services, and online retailers. State unemployment agencies and the Small Business Administration are also hiring to meet the demand for their services during this public health crisis.

FOR MORE INFORMATION

We will continue to monitor this situation and release updates. For more information or assistance, please contact our Human Resources team at 210–775–6082, toll-free at 1–888–757–2104, or [email protected].