10/19/2018

New AHPs Arrive in Texas

UHC OFFERS 3 GEO-BASED AHP OPTIONS

They weren’t born in Texas, but they got here as fast as they could! UnitedHealthcare (UHC) has introduced three geographically-based Association Health Plans (AHPs) that are now available in Texas. UHC is offering some of their most popular plans to associations that would like to set up AHPs, and they anticipate premium savings for certain groups compared to the ACA’s adjusted community rating structure. If we are your benefits consultant, we will review all of your options, including involvement in an AHP, as part of your renewal. If you have recently renewed, we are also comparing your recent renewal against the new geographical-based AHPs available with UHC and will let you know if it is worthy of your consideration.

REMIND ME: WHAT IS AN AHP?

AHPs are group health plans offered through associations or employer groups. By using an AHP, small employers “band together to purchase health coverage,” thus creating a large group and potentially experiencing the associated benefits, such as

- less regulatory complexity

- more flexibility in plan design because AHPs are allowed to offer large group plans, which are not subject to many of the ACA’s requirements

- more flexibility in rating as these groups are not subject to adjusted community rating that applies to small group plans under the ACA

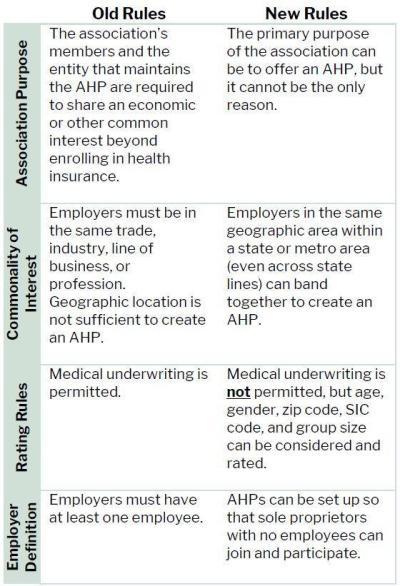

While AHPs have existed for years under the “old rules,” in June, the Department of Labor released “new rules” for AHPs in response to an executive order that President Trump issued in October of 2017. AHPs can now exist under both the old rules and the new rules. Due to these changes, we expect to see more AHP options available to businesses wanting to purchase group health insurance.

WHO SHOULD CONSIDER AN AHP?

Because of the additional rating rules allowed for AHPs, they create a separate avenue for groups to seek health insurance coverage. As a result of the ACA, many groups either continued on their old plan designs (Transition Relief) or converted to Self-funded plans. Unlike Transition Relief and Self-funded plans, the geographical-based AHPs are not medically underwritten. For this reason, depending on health status, Transition Relief and Self-funded plans may have more competitive rates than an AHP for a particular group. (Please note that a trade-based AHP set up under the old rules can use medical underwriting. AHPs set up under the new rules cannot.)

That said, AHPs are able to take into account more factors than the ACA’s adjusted community rating and don’t have many of the plan limitations that are placed on small plans. Unlike the ACA’s adjusted community rating, which mandated that only age, tobacco use, family size, and zip code could be used for rating purposes, AHPs can also rate based on gender, group size, and SIC code.

For young, healthy groups that are predominantly male, AHP rates may be higher than Transition Relief or Self-funded plans but lower than the ACA’s adjusted community rating.

For smaller employers with more claims experience, where health status is a concern, AHPs may be a good option. These groups would probably not fit well into the Transition Relief or Self-funded models due to medical underwriting requirements.

In many cases, AHPs work with a network of insurance consultants and brokers, who are able to help members and prospective members with getting quotes through the AHP.

UHC’s AHPs

Three geographical-based AHPs operating under the new rules are currently using UHC’s platform:

- West Texas Employer Health Plan: The Lubbock Chamber of Commerce engaged with UHC to create this AHP.They arranged for exclusivity in 34 counties in the Lubbock area.Employers must be members of the Lubbock Chamber of Commerce to participate.

- Healthy VIEW of East Texas: The Longview Chamber of Commerce engaged with UHC to create this AHP.Employers must be members of the Longview Chamber of Commerce to participate.Longview did not arrange for exclusivity, so other AHPs can be offered in this area.

- Business Fund for (BFF) Texas Children Battling Cancer: BFF is an organization with a mission to provide social and financial support to Texas families with children who are battling cancer.BFF engaged with UHC to create an AHP that is offered everywhere in Texas except for the 34 counties where the Lubbock Chamber of Commerce has exclusivity.Employers who would like to join this AHP will need to pay a $500 membership fee, which appears as a line item on their first invoice and will recur annually.

OTHER OPTIONS

Along with the changes to rules on AHPs, some other options for placing health insurance coverage are also being discussed. These ideas are not new but merit covering briefly to provide more perspective on the universe of options that are available. As stated in the Book of Ecclesiastes, “What has been is what will be, and what has been done is what will be done; there is nothing new under the sun,” even when it comes to health insurance.

- Captive Insurance: According to National Association of Insurance Commissioners, “A captive is an insurance company created and wholly owned by one or more non-insurance companies to insure the risks of its owner (or owners). Captives are essentially a form of self-insurance whereby the insurer is owned wholly by the insured. They are typically established to meet the risk-management needs of the owners or members.”For health insurance, captives typically comprise multiple employers.These plans provide another avenue to place health insurance coverage and may provide more flexibility for members who need it.

- Provider Network Plans: Some hospital systems, such as Baptist Health System, market their network.In many cases, access to the network is sold to insurance companies so that the providers are considered to be “in network”; however, these provider network plans can also be marketed directly to employers that create their own self-insured health plan.While in some cases, the rates may appear to be favorable, the challenge with these plans is that they only provide coverage when a member uses that hospital system’s providers.Generally, participants have no coverage for providers outside of that hospital system, which can be problematic.

FOR MORE INFORMATION

For more information on AHPs or other assistance, please contact our Employee Benefit Services team at 210–640–1789, toll-free at 1–888–757–2104, or [email protected].