6/13/2018

The Tax Law Has Changed: You Should Review Your Estate Plan

Please click here for a PDF copy of this article: The Tax Law Has Changed: You Should Review Your Estate Plan

“In this world nothing can be said to be certain, except death and taxes.” Estate planning involves both of those certainties. The Tax Cuts and Jobs Act has changed the tax law as it relates to estate taxes, with lifetime exemptions doubling. While these changes are set to expire in 2025, families could take advantage of the new tax law in the interim.

WHAT HAS CHANGED?

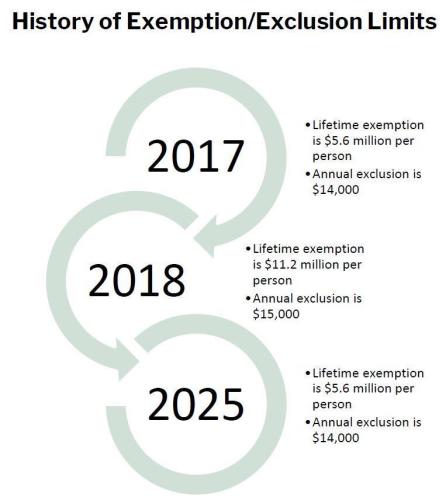

Lifetime gift tax exemptions—or the total amount that someone can give away over the course of his or her lifetime—have doubled from $5.6 million per person to $11.2 million per person. The annual exclusion—or the amount of money that may be given to another person each year without incurring a gift tax—has seen a slight increase from $14,000 to $15,000.

Because the new exemption limits are not permanent, it may be prudent to take action sooner rather than later. When the exemptions revert back to current limits, you could lose the opportunity to use them.

The exemptions apply to gifts as well as inheritance. In some cases, transfers could be made earlier than originally planned so as to take advantage of moving appreciating assets to the next generation.

One challenge to keep in mind is that the step up in cost basis remains but is only available for inheritance and not with gifts. For this reason, assets with very low current cost basis need to be evaluated carefully with a tax professional. All gifts should be made using the appropriate estate planning strategy.

WHAT ACTION SHOULD BE TAKEN?

At the very least, we recommend consulting with your estate attorney to review your wills. Older wills prepared under different laws and when the limits were significantly lower may have language that provides for assets up to the exemption limit to go into an estate credit shelter trust (CST) for the next generation. This was typically set up so that each spouse could take advantage of the full exemption.

Today the exemption limit is higher than most estates, and it is no longer necessary to “claim” the exemption by utilization of a CST. If the estate today is worth $10 million, for example, a death under this will could result in all assets for the decedent moving into a CST and none to the spouse directly or through a spousal trust.

Texas is also one of the states where irrevocable trusts can be decanted for certain reasons, so it may be advisable to reevaluate your entire estate plan with your attorney in light of current rules and what your objectives are today. The changes to the law provide an opportunity to evaluate your estate plan to make sure that it is set up in the most advantageous way for your situation.