2/6/2018

Common W-2 Questions

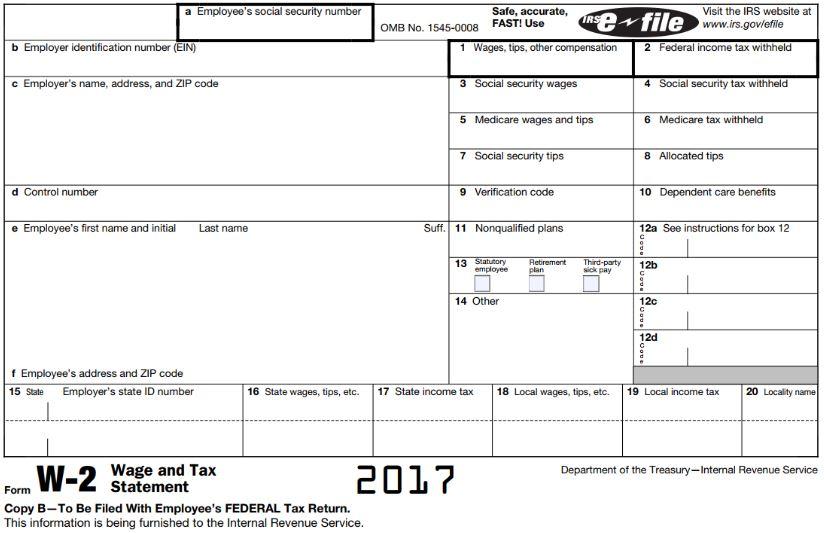

Tax season is upon us! To help ring in the season, we would like to share answers to the top questions we get on Forms W-2.

Why don’t my gross earnings on my last paystub match the compensation on my W-2?

Your Form W-2 provides the amount of your taxable wages not gross wages. Any pretax deductions (medical, dental, vision, and so on) will affect the wages listed on your Form W-2. To calculate your taxable wages, you will need to subtract your annual pretax deductions.

Three examples are provided below to help illustrate how you can calculate your W-2 based on your final paystub of the year.

Example 1: An employee earns $50,000 and does not have any pretax deductions. In this case, the amounts reported in Boxes 1, 3, and 5 will each be $50,000.

Example 2: An employee earns $50,000 and has pretax medical, dental, and vision deductions totaling $5,000 for the year. In this case, the amounts reported in Boxes 1, 3, and 5 will each be $45,000.

Example 3: Like Example 2, an employee earns $50,000 and has pretax medical, dental, and vision deductions totaling $5,000 for the year. However, this employee also contributed a total of $3,000 to a 401(k), which is another common complicating factor because the 401(k) deduction is only pretax for federal income tax but not for FICA taxes (Social Security and Medicare). For this reason, this employee's Form W-2 would show the following:

Box 1—Wages, tips, other compensation: $42,000

Box 2—Social security wages: $45,000

Box 3—Medicare wages and tips: $45,000

Remember, not all deductions from your pay check are pretax, so the more deductions, the more complicated the calculations. Other complicating factors are reimbursements for mileage, which generally appear in the earning section but are not counted toward taxable wages, and taxable fringe benefits, such as the personal use of a company vehicle or other company-paid benefits that may not be listed on your pay check but are included in your taxable wages on your Form W-2. It is always a good idea to get help from a tax professional to ensure you are filing your taxes properly.

Why doesn’t my W-2 reflect my current salary?

The wages reported on your Form W-2 are calendar year wages, meaning these wages were paid to you in 2017. Income from hours worked in December of 2016 may be included if you were actually paid for those hours in 2017; in addition, hours worked in December of 2017 may not be included if you were actually paid for those hours in 2018.

Why doesn’t my W-2 have a Control Number in Box D?

In short, this field (Box d—Control number) does not need to be used. It is completely optional and may be used by a payroll department to identify unique Forms W-2 within their own system. The IRS does not use this information. For this reason, you should not have to enter any information into this section; however, when dealing with technology, some challenges can occur.

When attempting to file electronically, some users may get errors regarding an empty Control Box D. If this happens to you, you can try entering any number into Box d—Control number in the following format: 12345 67890 (5 digits, space, 5 digits).

If you are attempting to import a Form W-2 and are prompted to fill in a value for Box d—Control number, you may need to skip the import and manually enter the information from your Form W-2.